Trust is on the rise

Contract duration indicates trust is on the rise

VPPerform discovered a significant average contract duration increase indicating trust is on the rise in the Dutch ICT outsourcing market. What we found was that over the past few years, both the total term and the initial contract term are lengthening. Whether or not this is considered to be a maturity indicator in this market, the buyer’s faith in their suppliers, and vice versa, clearly is strengthening.

Fixed initial term offers providers security

Outsourcing contract duration and the specified terms and agreements are some of the many important components of a healthy and balanced sourcing relationship. Most sourcing contracts are built around an initial term (fixed) and one or more renewals, after which the contract expires. A cancelation during the initial term for reasons other than non-performance is difficult and, in most cases, will result in severe financial penalties. That's why a fixed initial period gives both parties some security to materialize the business case.

What is needed is an initial term that is long enough to allow providers to spread the start-up investments over multiple years. A lengthy initial term also provides sufficient time to earn back on-going investments needed to optimize the service delivery (and margin) over time, which, inevitably, is the only way providers can offer the customer attractive pricing and quality of service.

However, while providers are in favour of longer initial terms, customers want to limit the length for reasons of their own. Shorter initial terms allow for flexibility in both the sourcing strategy and the selection of “fit for purpose” sourcing partners. Customers also want to ensure market conformity (pricing) over time. Most contracts have benchmarking clauses to cover this risk, however, it is not an easy exercise to execute those clauses.

So how do these powers balance out and how did it develop over the years?

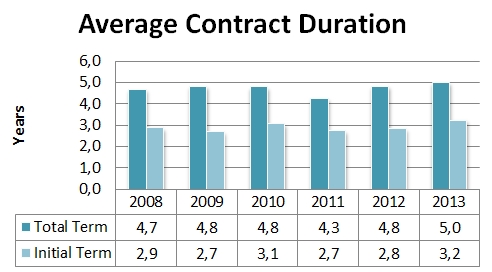

From the analysis undertaken by VPPerform, the average Total Contract Duration between 2008 and July 2013 is 4.7 years, and the average initial term over the same time period is 2.9 years. The graph below provides the breakdown per year.

Total Term includes all contracts with disclosed end-dates, Initial Term includes all contracts with disclosed term breakdown, 2013 includes contracts up to July 1st 2013.

A number of interesting observations can be made here. First, the average initial term proportion of the total term remains relatively stable at approximately 60-65%. After a slight dip in 2011, the negotiated initial term and the total term indicate an upward trend. This trend is likely due to both the increased need to negotiate lower prices and the reducing customer risks as sourcing arrangements become more selective (smaller), multi-vendor, and are more often second or third generation.

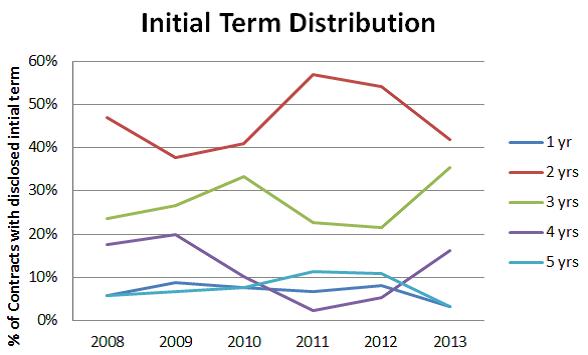

Looking at the initial term distribution, evidence suggests a significant increase in 3-year and 4-year initial term contracts and a decrease in 1-year and 2-year initial term contracts. While 2-year initial term contracts are the most common, 3-year initial term contracts are gaining popularity and could become leading by year end.

Why are these developments noteworthy?

VPPerform believes the average initial term can be viewed as an ICT Outsourcing market maturity indicator. A longer average initial term indicates stable sourcing strategies, lasting relationships built on performance and trust, increased value for both customers and providers and, last but not least, reduced transition costs.

The 2-year initial term spiked during the peak of the recession in 2011, which seems to back up this theory. In that timeframe, purchasers clearly exercised their need for financial security and lower risk purchases, putting a solid business case for providers on thin ice. Today, this trend is reversing and has ignited a growing mutual trust that is translating into longer partnerships. This clears the path for providers to aim for longer initial terms and to keep striving for that common ground where both parties are comfortably steering towards a materialization of the sourcing business case.

In the meantime, we will keep an eye on what we have coined the "Trust Term".

Need Help?

Evaluate VPPipeline

Monitor what's happening in the Dutch ICT market. Registered users have access to recent transactions reports. You don't need a subscription to register, it's free.

About VPPerform

VPPerform supports clients in winning deals and developing existing or new strategic accounts.

- © 2026 Copyright VPPerform

- Disclaimer

- Terms of Use

- Privacy Policy

- Contact

-