Why contract expiration should be an inspiration

Why contract expiration should be an inspiration

Why contract expiration should be an inspiration

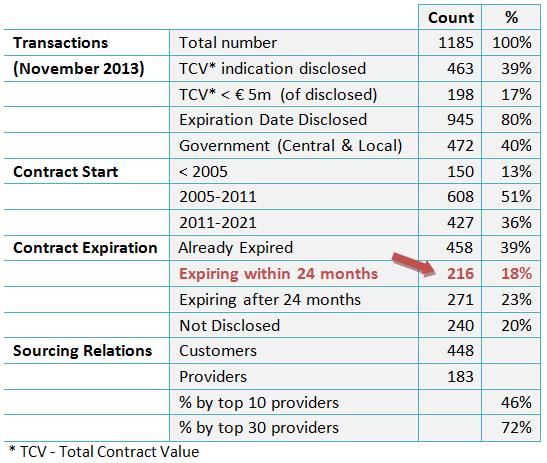

The expiration of major sourcing contracts force customers to reconsider and evaluate the existing relationships. VPPipeline found 216 transactions to be considered for renewal in 2014 and 2015. Of these transactions, 39% have a disclosed value adding up to a total contract value of a minimum of € 2.6 Billion.

“As-is” service provision versus “As-is” market reality

During the last decade a majority of second and third generation outsourcing contracts in the Netherlands showed a shift from “one-stop shop” to “best-of-breed” approaches. As a result the number of multi-vendor sourcing solutions increased equally. This multi-sourcing development is now further strengthened by the growing deployment of cloud solutions.

Customers evaluate (often supported by sourcing experts) the latest available cloud offerings and want to benefit from what’s available in the market. What we see now, is an even more selective approach by customers when they reconsider next generation outsourcing transactions. In the years to come customers will more often combine “classic” (bespoke) outsourcing with selective industry standard “as a Service” solutions. Because of these trends, we expect to see a growing number of transactions with a lower Total Contract Value.

Incumbents will not only have to demonstrate customer satisfaction and a positive commercial benchmark to keep the competition away from a renewal. On top of that providers will need to resolve the gap between “as-is” service provision and “as-is” market reality (competing cloud offering and the need to manage the integration of services).

Most of the sourcing contracts expiring in the next two years have not been shaped to deal with the developments described above. Therefore each and every one of these expirations is a tangible opportunity and should be a source of inspiration for service providers.

216 expiring contracts

VPPipeline keeps track of all disclosed ICT outsourcing transaction in the Netherlands, providing a valuable source of information for business development professionals. For 80% of the disclosed transactions VPPipeline has analyzed, the contract expiration date is indicated. We found 216 transactions to be considered for renewal in 2014 and 2015. This table provides some details about the transactions and publications available to our subscribers.

What and When

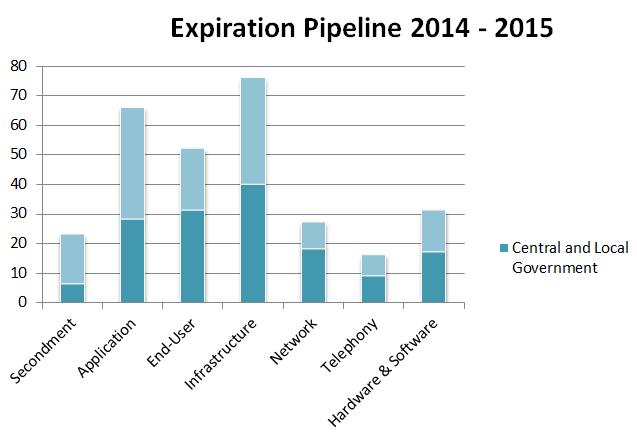

It's quite useful to know how many transactions expire when. In the below diagram we provide the number of transactions expiring in relation to the type of service. Also, we have visualized how many transactions are related to government organizations (central and local). Multi-service transactions (29% of the transactions cover two or more service domains) appear in multiple columns in the diagram. The Telephony service domain is still under research and therefore not complete yet.

Year-end peak

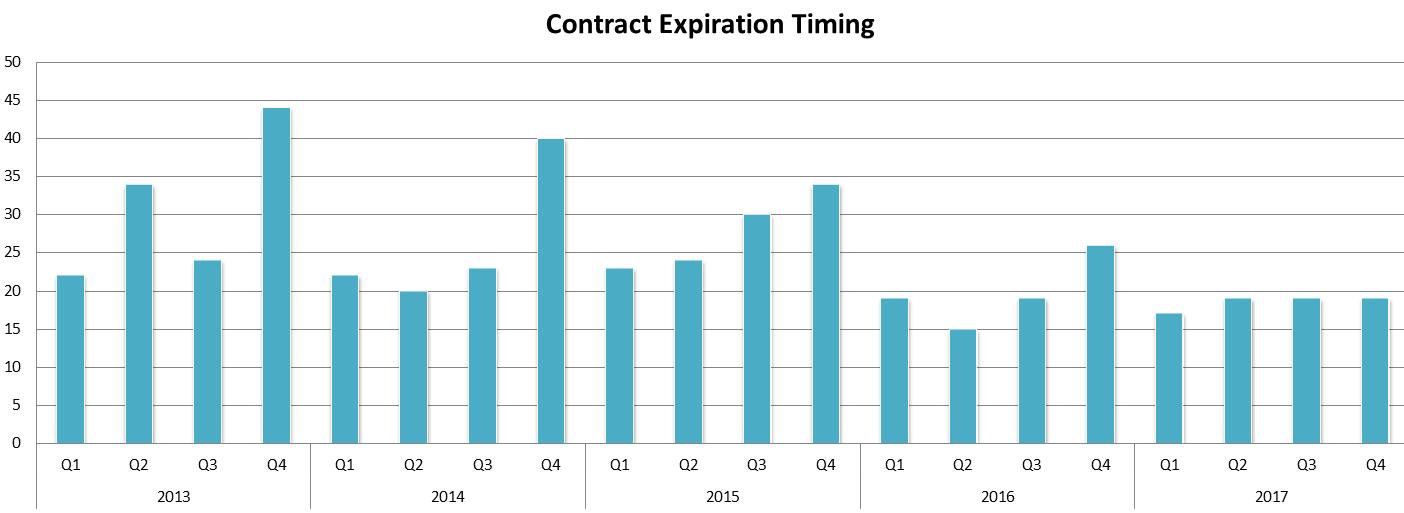

Another interesting look is to see how many transactions expire when. This view indicates an average of 20 transactions per quarter expiring with a typical peak at year-end which is most likely caused by customers trying to keep annual numbers comparable and providers aiming to achieve performance objectives in the fiscal year.

The differentiating factor

Most providers combine annual account planning (existing business) with a top-down business development plan (new business), often based on an overall sales and marketing strategy by portfolio and industry verticals. The contract expiration calendar represents tangible market potential and offers a wealth of information to address the gap between the “as-is” service provision and “as-is” market reality (competing cloud offering and the need to manage the integration of services).

Resolving this gap will be the differentiating factor in business development, right now and in the years to come.

VPPipeline, inspiration from expiration.

Need Help?

Evaluate VPPipeline

Monitor what's happening in the Dutch ICT market. Registered users have access to recent transactions reports. You don't need a subscription to register, it's free.

About VPPerform

VPPerform supports clients in winning deals and developing existing or new strategic accounts.

- © 2025 Copyright VPPerform

- Disclaimer

- Terms of Use

- Privacy Policy

- Contact

-